Early 2018 was filled with a lot of rumors, misinformation and flat-out confusion over pending changes to solar with the new administration. One of the largest points of discussion was that of the Solar Tax Credit or Solar Tax Incentives. The bill was renewed in 2015 by Congress – as it was seen as a landmark initiative to support the ever-expanding solar industry. Yet, with the inauguration of Trump and the head of the EPA staunchly against tax credits, many consumers feared the solar tax credit was on the chopping block.

What is the Solar Tax Credit?

The Solar Tax Credit is officially known as the “Solar Investment Tax Credit”, or ITC. This is a dollar-for-dollar reduction in the federal tax bill of any homeowner who pays for a solar installation. This tax credit was first enacted in 2005 and renewed in 2008 and 2015. It is offered by the U.S. Federal government as a tax incentive for homeowners and business owners to go solar while making the process more more affordable.

How Much Do I Get Back with the Solar Tax Credit?

This number is highly dependent on your overall tax liability, or how much money you owe to the federal government at the end of a tax year. However, in terms of finding monetary value within the system you purchase, consumers can calculate the value of the ITC they can claim to be 30% of the total cost to purchase and install solar.

For example, if you spend $20,000 on a solar system, your 30% tax credit would be $6,000. If you only owed $4500 in taxes, your tax bill will be reduced to $0 and you receive an additional $1500 on your next tax return. (Please contact a tax expert for more information)

Will the Solar Tax Credit Expire?

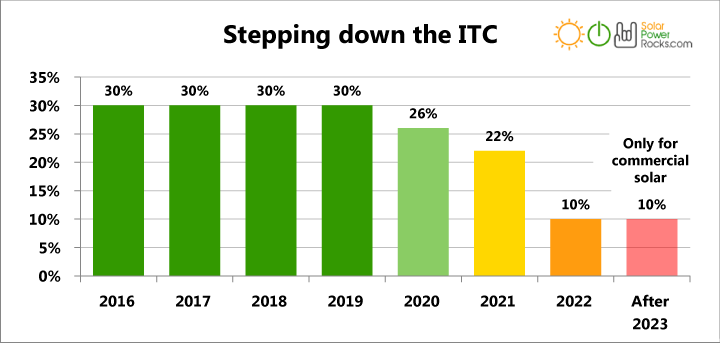

Photo Credit: Solar Power Rocks

No! There is still time for homeowners and business owners to take advantage of the federal ITC. Through 2019, the credit will remain at 30%. In 2020 it will minutely drop to 26% and down to 22% in 2021. In 2022, the tax credit drops to 10% and by the end of 2023 the tax credit will be ZERO. However, after 2023, commercial companies who install and maintain solar systems and sell the power to another entity (homeowner, business, utility company, etc.) will still be able to take an advantage of a 10% tax credit indefinitely, assuming there are no more changes instituted by the administration.

How Do I Claim the Solar Tax Credit?

As solar professionals, we recommend you reach out and work with your tax professional. As we are committed to being your solar expert, we cannot honesty say we are tax experts. What we can say that it is a simple process where you claim your tax credit on your 1040 form.

What Next?

As your solar professional, we recommend you reach out to one of our Energy Advisers. Whether it be by email, phone, or a quick stop by our Educational Showroom, located in the Historic, Downtown Brentwood corridor, a short conversation can outline steps to going solar. We can overview the process, finance, and give you an accurate look at what your solar tax credit will look like, assuming you are committed to going solar before the credit changes in 2020. There is no better time than now to learn about solar for your home or business.

Here is some information you may find useful:

- Solar Benefits Extend Beyond Homes and Help Business Owners

- No Better Time Than Now for Commercial Solar

Leave a Reply