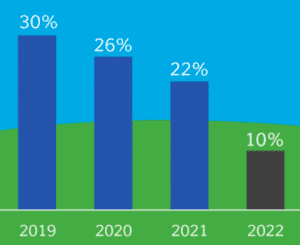

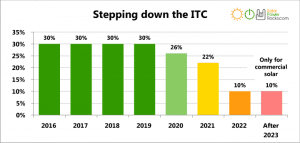

Solar Tax Credit The Investment Tax Credit (ITC) is a federal tax credit that allows homeowners and business owners to deduct 30% of the total cost of installing a solar energy system from their federal taxes. The tax incentive initiative was implemented to support the dependency of renewable energy and has helped annual solar … [Read more...]

Federal Tax Incentive For Solar: Spring Install

It wasn’t too long ago where we spoke about a Spring Harvest of solar. If you didn’t happen to read that post, a quick review will remind us that installing a solar PV system in the Springtime is frequently seen as “the BEST” time to install a solar system. We still believe, like other industry leaders, that the spring season is an ideal time. … [Read more...]

Commercial Solar Energy: Understanding The Changes

With the pending changes in California legislation, understanding solar options for commercial solar energy building owners and owners of multi-family homes is important. California’s Building Energy Efficiency Standards are updated approximately every three years. With the next set of standards being rolled out in 2019, and compliance mandates in … [Read more...]

An Update on the Solar Tax Credit

Early 2018 was filled with a lot of rumors, misinformation and flat-out confusion over pending changes to solar with the new administration. One of the largest points of discussion was that of the Solar Tax Credit or Solar Tax Incentives. The bill was renewed in 2015 by Congress – as it was seen as a landmark initiative to support the … [Read more...]

Commercial Solar Installers: Benefits Extend Beyond The Home

Solar Roots Most people around town recognize the Del Sol Energy logo for the work we complete with local homeowners. However, our roots are in commercial solar installations. What does that mean? It means, when we started our business, we were focused working with business owners to help them understand the benefits of going solar while helping … [Read more...]