Solar Tax Credit

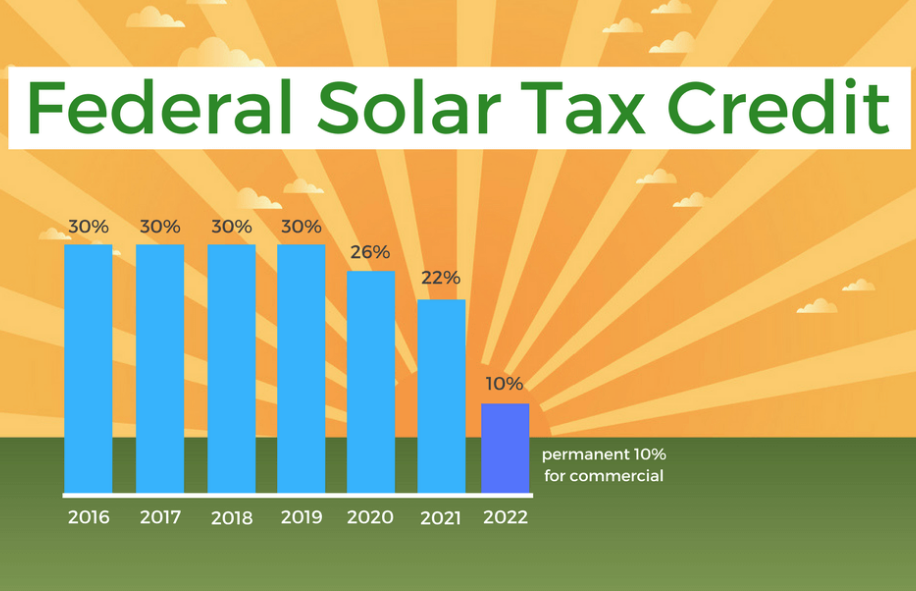

The Investment Tax Credit (ITC) is a federal tax credit that allows homeowners and business owners to deduct 30% of the total cost of installing a solar energy system from their federal taxes. The tax incentive initiative was implemented to support the dependency of renewable energy and has helped annual solar installation grow by 1600% since the ITC was implemented. Through the end of 2019, the solar tax credit is set at 30% for both residential and commercial customers. The ITC benefit then decreases to 26% in 2020 and then drop off 22% in 2021. Beginning in 2022, the tax credit is no longer available to homeowners but sits at 10% for business owners.

What Qualifies for the Tax Credit?

There are a few stipulations for homeowners and business owners to qualify for the solar tax credit or the ITC.

- First, you must purchase your solar system. Although financing options provide for lease and PPA (Power Purchase Agreement) agreements, homeowners and business owners only qualify if they purchase the solar system.

- Second, you must own your home or the building in which your business is based.

- Finally, your federal tax liability must be sufficient to qualify for the tax credit. You are able to extend the tax credit to your liabilities for up to 5 years, however, if you do not have tax liabilities, you will not qualify for the tax credit.

- The last point to remember is that for your solar installation to qualify for the 30% tax credit, you must have your panels installed by December 31, 2019.

How Does the Tax Credit Work?

The ITC, or solar tax credit, is a dollar-for-dollar reduction in the income taxes that a person or a business owner claiming the credit would otherwise pay the federal government. The amount of solar tax credit is based on the size of your solar investment. What this means, is that your solar tax incentive may be different than your neighbors, if you invested in different sized solar systems. When it comes to speaking numbers, if you purchase a solar PV system that costs an average of $25,000, your tax credit would be $7,500. This means you would have a total of $7,500 credited to your overall federal tax liabilities. It also means that the total cost of your system would be reduced to $17,500. As a solar company, we always recommend working closely with your tax professional to ensure you qualify for the complete 30% tax incentive.

Here are a few businesses and organizations that have gone solar and taken advantage of the Solar Tax Credit

Delta Valley Health Club in Brentwood CA

Delta Bowl in Antioch CA

Summerset III in Brentwood CA

Here are some articles you may find helpful:

Top 10 Questions You Should Ask Any Solar Company

What are my Solar Finance Options?

Why are Solar Mounting and Racking Systems So Important

Do Solar Panels Add Value to My Home?

An Update on Tesla and Solar City

Recommended Video:

Leave a Reply